- How do I use the BizFinx preparation tool prepare my company’s financial statements in XBRL format?

- Does my company need to prepare XBRL file?

- I have encountered genuine errors when preparing the Property, Plant & Equipment (PPE) template. How can I resolve these errors?

- I have encountered genuine errors Misc_006 and Misc_007 for my company’s accounts which are consolidated for the first time and do not have comparative figures for the previous year. How can I resolve this?

- I have submitted my company’s financial statements using the text block element in the Full set of Financial Statements template. Why am I encountering validation errors Misc_005 and Misc_041?

- I am unable to import prior year Excel file to populate prior year figures. What should I do to populate prior year figures?

- If the uploaded XBRL file has an error, how do i delete the incorrect uploaded XBRL file?

- I have encountered GEN-02 error, how do I resolve it?

More FAQs are available here (PDF, 1.11MB).

Question 1

How do I use the BizFinx preparation tool to prepare my company’s financial statements in XBRL format?

The BizFinx preparation tool is provided by ACRA free-of-charge to facilitate companies' preparation of XBRL financial statements in accordance with the revised XBRL filing requirements.

Steps on how you can go about preparing and filing your XBRL financial statements are available here.

More information on XBRL preparation and filing (including help guides, such as quick guide for BizFinx preparation tool) is also available in the various chapters under Help Resources.

Question 2

Does my company need to prepare XBRL file?

Please refer to the filing requirements for various company types here.

Question 3

I have encountered genuine errors when preparing the Property, Plant & Equipment (PPE) template. How can I resolve these errors?

The errors commonly met by preparers are as follows:

Preparation Tool v3.4 (revised XBRL filing requirements)

a. Correlated_070: To ensure that the value provided for totals to be the sum of values submitted for its child fields. Preparers can make use of the auto-calculate function as listed in the last column totals.

b. Crossstatement_046 and crossstatement_047: Preparers check to ensure that the PPE template is complete.

Preparation Tool v2.9 (current XBRL filing requirements)

a. Misc_002, Misc_040: The value provided for totals should be the sum of the values submitted for its child fields.

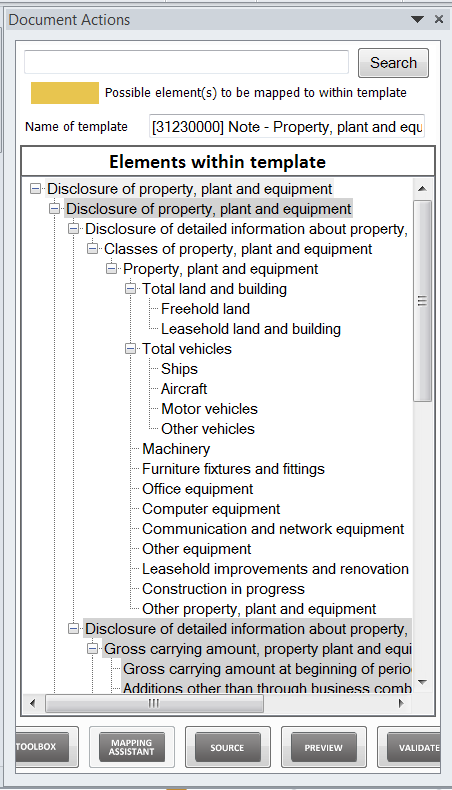

The parent-child relationship of different asset classes may be viewed from the Mapping Assistant.

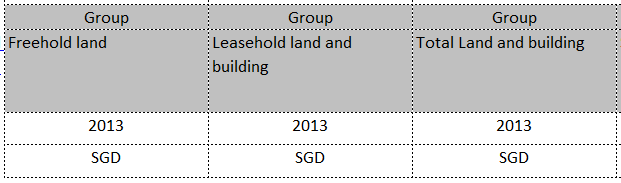

An area where users frequently encounter issues is for the “Total Land and Building” element. “Freehold Land” and “Leasehold Land and Building” are sub-class elements which will add up to be “Total Land and Building”.

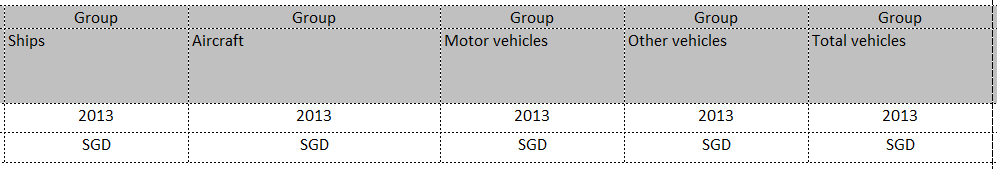

A similar element for which errors are frequently made is “Total Vehicles”. Preparers should ensure that the sub-classes of vehicles sum up to the value for “Total vehicles” as well.

In addition to checking the subtotals for “Total Land and Building” and “Total Vehicles”, preparers should ensure that the value for “Total Assets” should be equal to the sum of values of the individual fields of assets provided, taking note not to double count for the sub-classes of “Total Land and Buildings” and “Total Vehicles” should these two subtotals be used as well.

Lastly, preparers should check that Carrying value at beginning/end of period is equal to the value of Gross carrying amount at beginning/end of period minus Accumulated depreciation, amortisation and impairment at beginning/end of period.

In summary:

| Description | Elements to Check |

|---|---|

| Check for domain members | Total Land and Building

= Freehold Land + Leasehold Land and Building |

| Check for domain members | Total Vehicles = Ships + Aircraft + Motor Vehicles + Other Vehicles |

| Check for elements | Total Assets = Sum of all asset classes disclosed |

| Check for elements | Carrying value at beginning/end of period

= Gross carrying amount at beginning/end of period - Accumulated depreciation, amortisation and impairment at beginning/end of period |

b. Misc_023: Closing balance should be the sum of opening balance and movements during the financial reporting period.

Preparers should ensure that the aggregate value of opening balances and movements during the year is equal to closing balance values.

The general principles are set out as follows:

| Description | Elements to Check |

|---|---|

| Gross carrying amount at end of period | Gross carrying amount at beginning of period + Movements (e.g. Additions other than through business combinations, Disposals, Write-offs) |

| Accumulated depreciation, amortisation and impairment at end of period | Accumulated depreciation, amortisation and impairment at beginning of period + Movements (e.g. Acquisition through business combinations, Depreciation, Disposals, Write-offs) |

c. Misc_043: The breakdown to PPE template should be provided when there is corresponding value for PPE in the Statement of Financial Position.

If you have disclosed the opening, adjusting and ending balances but are unable to resolve the genuine error, please contact us by emailing the signed AGM FS and XBRL.zip file to ACRA_XBRL_Application@acra.gov.sg.

Question 4

I have encountered genuine errors Misc_006 and Misc_007 for my company’s accounts which are consolidated for the first time and do not have comparative figures for the previous year. How can I resolve this?

Preparation Tool v3.4 (revised XBRL filing requirements)

Where the company consolidates for the first time, Misc_006 and Misc_007 is not applicable to the company. No exemption will be required. The preparers may proceed to validate online.

Preparation Tool v2.9 (current XBRL filing requirements)

You may seek exemption from ACRA for these genuine errors if it is confirmed that the XBRL data being submitted is correct and accurate. For information on applying exemption, please click here.

Question 5

I have submitted my company’s financial statements using the text block element in the Full set of Financial Statements template. Why am I encountering validation errors Misc_005 and Misc_041?

Please review the information in the text block element and ensure that you have submitted a full set of financial statements (including statement by directors, auditors’ report, four primary statements and notes to the financial statements) as tabled at the AGM (Annual General Meeting) using this text block element.

Validation errors Misc_005 and Misc_041 check for the completeness of information submitted in the "Disclosure of complete set of financial statements [text block]". This includes checks for specific key-words and the number of characters submitted in the text block submitted. Misc_005 is a possible error which serves as a reminder for you to confirm that you have provided the full set of financial statements. Misc_041 is a genuine error, for which you can seek XBRL exemption if you confirm that the full set of financial statements has been provided correctly.

Question 6

I am unable to import prior year Excel file to populate prior year figures. What should I do to populate prior year figures?

Only previously saved XBRL.zip file in compliance with ACRA XBRL Taxonomy 2013 or later is allowed to be imported or opened in the BizFinx preparation tool, in populating of prior year data.

To populate prior year data, you may:

- “Open” and “Load Prior Period Data” from previously saved XBRL.zip file upon opening of BizFinx preparation tool (recommended approach);

- Import the previously saved XBRL.zip file at any point in time during preparation, specifying prior period dates, in the BizFinx preparation tool; or

- Auto-tag / drag-and-drop together with prior year data from source document into the template.

Please note that there are significant changes from ACRA XBRL Taxonomy v4.1 to Taxonomy 2020 v1, and not all data elements will be imported. Preparers are to ensure the accuracy and the completeness of all its comparative figures.

Question 7

If the uploaded XBRL file has an error, how do i delete the incorrect uploaded XBRL file?

You may reuploaded another XBRL file without the need to delete previously uploaded XBRL file. The uploaded XBRL files will be kept for two weeks (14 days) from the date of upload. You will need to upload the XBRL financial statements again if the filing of Annual Return cannot be completed within that time frame.

Question 8

I have encountered GEN-02 error, how do I resolve it?

To resolve GEN-02 error, please refer to this link.