There are two key ways to prepare your company’s financial statements in XBRL format (XBRL FS) and file them as part of your company’s annual return:

a. Prepare XBRL FS using BizFinx preparation tool and file the annual return through the BizFile+ portal. The steps for this process are provided below; or

b. Use accounting software that can seamlessly prepare and file annual return (with Simplified XBRL FS) to ACRA. Refer to the list of software vendors for Seamless Filing initiative (PDF, 150KB).

Alternatively, you can also engage the services of a corporate service provider to help your company prepare XBRL FS.

Preparing your company’s financial statements in XBRL format using BizFinx Preparation Tool

Step 1: Download ACRA's free BizFinx Preparation Tool.

Step 2: Retrieve the financial statements tabled at your company’s annual general meeting (AGM FS). This is referred to as the “source document” in the Preparation Tool and can be in either Microsoft Word or Microsoft Excel format.

Step 3: Map the line items in your financial statements to the relevant tags within the ACRA Taxonomy. Complete all tabs in the template. Leave the data fields blank only if the information requested is not disclosed in the AGM FS.

Step 4: When completed, validate your XBRL FS offline. Review and correct any errors highlighted.

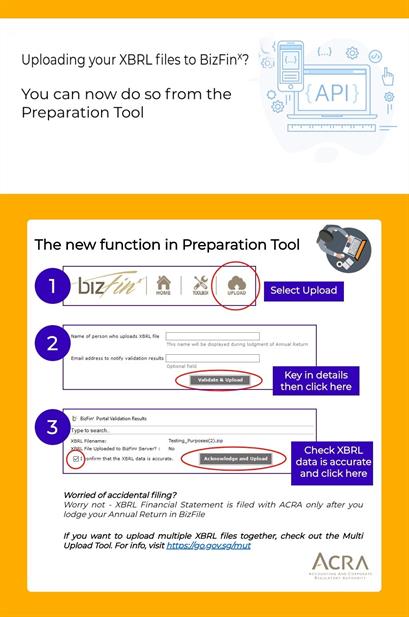

Step 5: Validate and upload your XBRL FS directly from the BizFinx Preparation Tool.

Click on the “Acknowledge and Upload” button to upload the XBRL FS. A message stating “Your XBRL file has been successfully uploaded” will be shown upon successful upload.

Note: Uploaded XBRL FS is available on the BizFinx server for up to 14 days. Hence, please ensure that you file your Annual Return together with your uploaded XBRL financial statements within 14 days.

Step 6: Login to Bizfile.

Step 7: File the Annual Return with the correct XBRL FS uploaded.