Overview: Strike Off Journey of a Company

Check the striking off criteria

You may wish to close the company for various reasons. One of the options available is to strike off the name of the company from the register.

As a director, you may apply to ACRA to strike off the company's name from the register. ACRA may approve the application if there is reasonable cause to believe that the company is not carrying on business and the company is able to satisfy the following criteria for striking off.

- The company has not commenced business since incorporation or has ceased trading.

- The company has no outstanding debts owed to Inland Revenue Authority of Singapore (IRAS), Central Provident Fund (CPF) Board and any other government agency. You may wish to liaise with the respective government agencies to confirm any outstanding obligations before applying.

- There are no outstanding charges in the charge register. A charge is a form of security interest that a company grants to a lender to secure a debt. Examples include mortgages over property (fixed charge) and security over inventory or cash (floating charge).

- The company is not involved in any legal proceedings (within or outside Singapore).

- The company is not subject to any ongoing or pending regulatory action or disciplinary proceeding.

- The company has no existing assets (such as equipment) and liabilities (such as outstanding employee salaries or debts) as at the date of application and no contingent asset and liabilities that may arise in the future.

- All/majority of the director(s) authorise you, as the applicant, to submit the online application for striking off on behalf of the company.

Please ensure that the company meets all the above criteria before you apply for striking off. An application made without satisfying these criteria could constitute a false declaration and may warrant an investigation.

Important: Outstanding Tax Credit

NOTE: Please ensure that there is no outstanding tax credit owing to the company before applying for striking off. When the company is dissolved, any tax credit due to the company will be paid over to the Insolvency & Public Trustee’s Office (IPTO). The shareholders of the defunct company may approach IPTO if they wish to claim the tax credit. Please note that IPTO may impose charges for the processing of the claim. For more information on how to make a claim, please visit IPTO's website.

Who can apply for striking off

Only the company officers (directors or company secretary) can apply to strike off the company. You may also engage a Corporate Service Provider to file on your behalf.

How to apply for striking off

The application is to be made online via Bizfile using Singpass or Corppass.

Log in to Bizfile and navigate to the "Apply to strike off business entity" eService. No filing fee or supporting documents are required for this transaction.

Important: Before you apply

- Ensure that the registered office address and company’s email address are updated in Bizfile before submitting the application.

- Ensure that there is no on-going summons issued to the company.

- The application will lapse if it is not endorsed by all/majority of the directors within 14 days of the application date.

- Corporate service provider authorised by the company to carry out the transaction must ensure that majority of the company directors have consented to strike off the company.

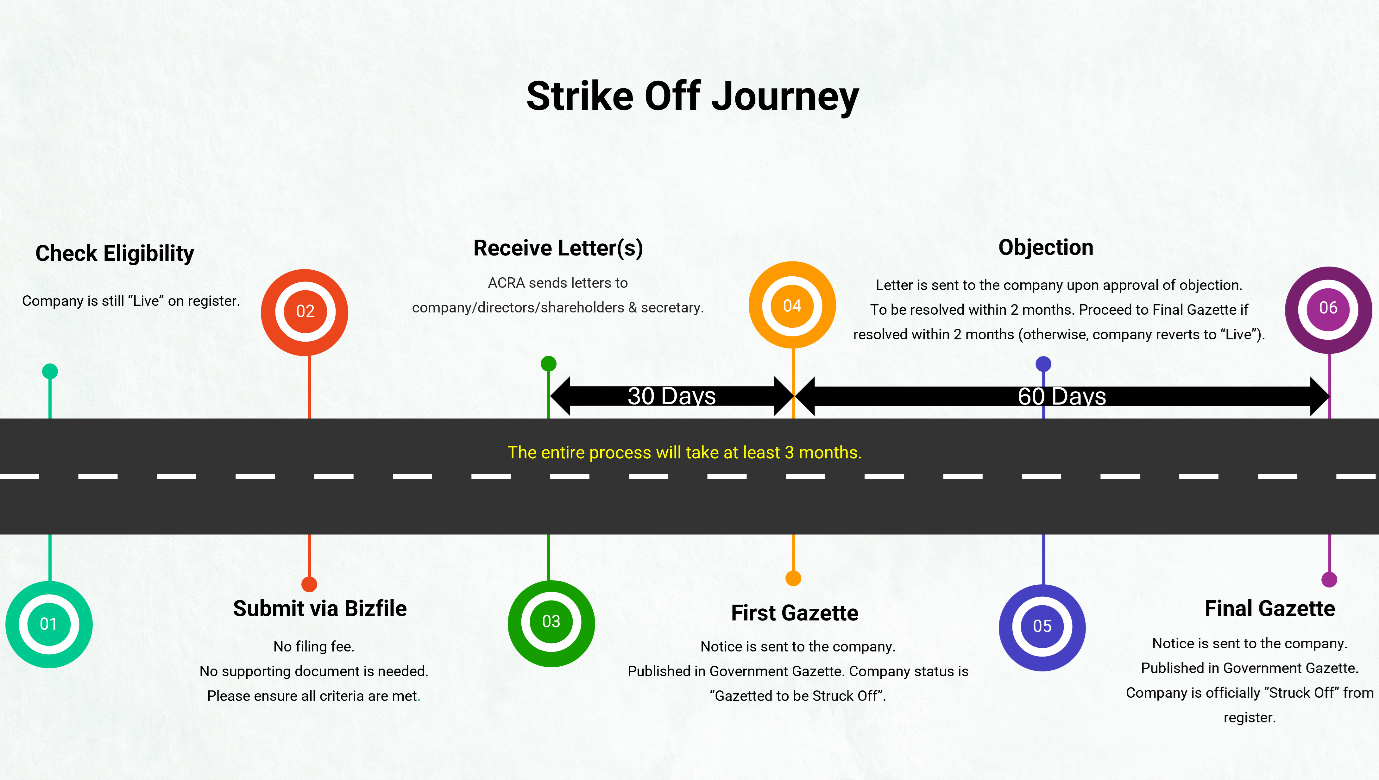

What to expect after filing the application - The Strike Off Process

The entire strike off process may take at least 3 months after the application is approved.

a) Once the application is approved, ACRA may send a striking off letter to the company’s registered office address, its officers (such as director, company secretary and shareholder) at their address in our records and to IRAS and CPFB.

b) If there is no objection, ACRA will publish the name of the company in the Government Gazette. This is known as the First Gazette Notification.

c) After 60 days from the First Gazette Notification, if there is no objection, ACRA will publish the name of the company in the Government Gazette and the name of the company will be struck off the register. The date that the company is struck off will be stated. This is known as the Final Gazette Notification.

Important: Understand the Difference Between Application Approval and Successful Strike Off

- Application Approval means ACRA has accepted your strike off application and will begin processing it. The company remains 'Live' and registered with ACRA at this stage.

- Successful Strike Off means the company has been removed from ACRA's register and no longer has legal existence.

Overview: Objection Process

Who can object and How to lodge an objection against striking off

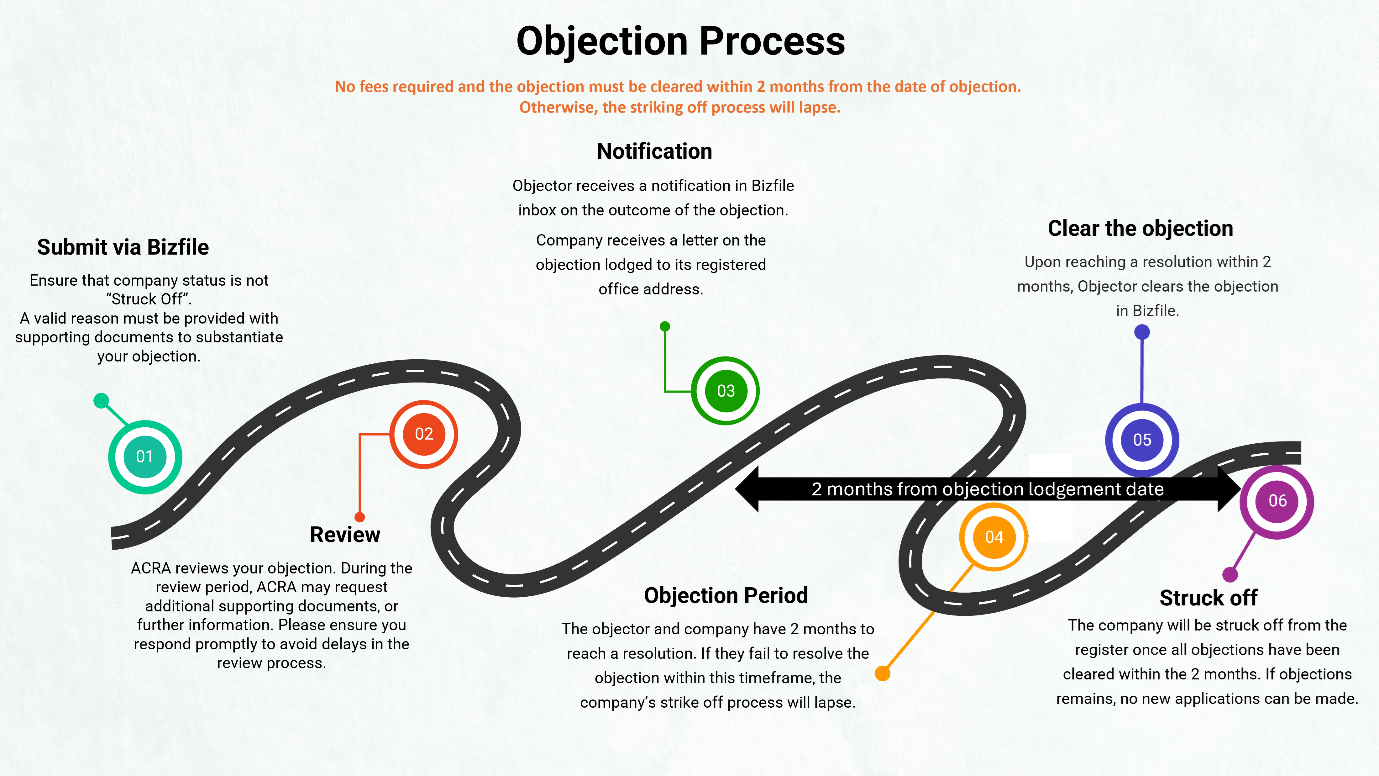

Any interested person can submit an objection against a striking off application through Bizfile. There is no fee payable for this transaction.

When submitting an objection, you are required to state the reason(s) for objection and upload the supporting documents for ACRA to review the objection. Objection without supporting documents may be rejected. ACRA may request for further documents/ information (if required) to facilitate the review.

Example of Supporting documents (non-exhaustive):

- Invoices / Purchase Orders

- Bank statements

- Utility bill or Lease agreement for office space

- Assets ownership

- Other agencies related documents (i.e. Notice of assessment from IRAS, CPF contribution, approved licence etc.)

- Accounts receivable / payable

- Agreements / Contracts signed for on-going or pending projects

- On-going/pending prosecution actions

- Proof of on-going legal actions

- Court documents

- Appointment of liquidators / Judicial Manager

If the objection is approved, ACRA will send a letter to inform the company of the objection. The letter will indicate the objector’s name and the objection reason. The company is given 2 months to resolve the matter. If the company is unable to resolve the matter within 2 months and the objection is not cleared, the striking off application will lapse. The company can only submit a new application after the objection has been cleared.

Note:

- Please note that only the lodger who lodged the objection can view the objection status in their Bizfile inbox.

Clearance of an Objection to Striking Off

The person who objects to the striking off application must log in to Bizfile to clear the objection within 2 months from the objection lodgement date, before ACRA can proceed to continue with the striking off process. There is no fee payable for this transaction.

Withdrawal of Striking Off Application

A company can apply for withdrawal of its application for striking off via Bizfile at any point of time before the company is struck off.

There is no filing fee for this transaction.

Restoration - After a Company has been struck off

A company can be restored within 6 years after the company's name has been struck off, by a Court Order. The Court Order must be lodged via Bizfile and the status of the company will be updated to “Live” once the lodgement is processed by ACRA. There is no filing fee for this transaction.

All companies that are “Live” on ACRA’s register are required to fulfil statutory obligations including filing of Annual Returns.