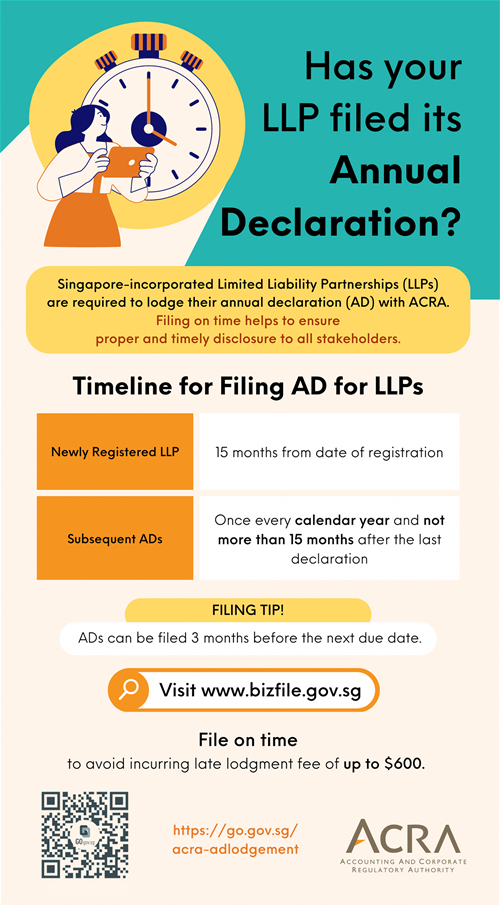

Under Section 30(1) of the Limited Liability Partnerships (LLP) Act, the manager of every LLP is required to lodge a declaration stating whether the LLP is solvent or insolvent (i.e. able to pay off its debts or not).

Under Section 30(3), the first annual declaration must be lodged within 15 months from the date of the registration of the LLP. Subsequent declarations must be lodged once every calendar year and not more than 15 months after the lodgment of the last declaration.

If the LLP requires an extension of time to lodge the declaration, it can apply for an extension of time under Section 30(4) of the LLP Act.

Accounts

Under Section 25(1) of the LLP Act, the LLP is required to keep accounting and other records which explain its transactions and financial position. The LLP is also required to prepare profit and loss accounts and balance sheets. However, these documents need not be lodged with ACRA.

Under Section 25(2), the LLP shall retain the accounting records for five years.